Lasă că s-au dat dreacu bursele.

Lasă căinarea falsă, că vai ce-o să pățească americanii.

Suntem fiecare preocupați de curul nostru.

Probabil una din cele mai realiste nu analize, ci explicații cu privire la efecfele politicilor tarifare, așa cum au fost, momentan, aplicate e dată de nenea ăsta, Austin Campbell, care nu știu cine e, dar ceea ce spune este măsurabil:

Tweetul ciordit aici

Definitions

First, let’s all speak the same language on some things. To understand what is going on, we need to have a common understanding, so I’m going to lay down some terms to make clear what I mean. If you disagree with what these are or functionally how they work, that’s a fact-based determination we can evaluate, after all.

Tariffs

A tariff is generally defined as a tax or duty imposed by a government on goods or services imported into a country. Tariffs are used to raise revenue for the government and, often, to protect domestic industries by making foreign goods more expensive compared to locally produced goods. Tariffs are typically paid by the importer (e.g. the domestic company importing the goods). Trade Deficit or Surplus The U.S. trade deficit is calculated by measuring the difference between the value of goods and services imported into the country and the value of goods and services it exports. Here’s a simplified formula: Trade Balance = Imports−Exports If the value of imports exceeds the value of exports, the result is a trade deficit. Conversely, if exports exceed imports, the result is a trade surplus.

Imports and Exports

As best I can tell, import and export values themselves were likely sourced from U.S. government data, such as the trade statistics compiled by the U.S. Census Bureau and U.S. Customs Service, which track goods transactions annually via the FT-900 report etc. These figures focus solely on physical goods (e.g., machinery, vehicles, agricultural products) and exclude services or digital trade, which are significant but harder to quantify in traditional trade balances. Those are “imports” or “exports” but not always captured. Nuance, but an important nuance. You can check this by comparing data sources, but I’m relatively certain the figures here exclude high margin services businesses. If someone from the Trump admin would like to provide me the data they used for the calculation to confirm or refute this, please drop me a line.

Baseline Stances

The overall stance of the economics profession and most finance professionals is that tariffs are counterproductive. Essentially, blocking yourself from buying cheap goods from others is going to cause inflation without increasing net productivity. It is saying that a tiny island like Kiribati with no advanced economy producing fish for you at subsistence wages is an insult, not a good thing, and thus you should make fish massively more expensive so we can force Tom from accounting to leave the office and go out on a fishing boat to fish for us locally. The traditional counterpoint to this comes from the national security crowd, who would state that tariffs on certain industries, while they may increase costs, are a national security imperative to make sure that we have local (both geographically and in terms of political control) industries that can produce the things we need in a time of conflict. In their world, if Kiribati sells us all our food but goes to war with us, we starve. Therefore, actually we do need Tom from accounting to leave the office and go out on a fishing boat to fish for us locally. I would contrast these two views as the global optimization view vs. the local redundancy view. Note there is probably no correct answer and the balance lies on a continuum between those two groups. For some industries (defense manufacturing, agriculture, medicine production) the national security argument is extremely strong. For other industries (children’s toy production, entertainment, luxury goods) the national security argument is much weaker. The other element to balance between those two views is the concept of short-term vs. long-term preference in how you think about these things. It’s entirely possible that the national security view does cause short-term pain, but the theoretical tradeoff is long-term defense and liberty, so the argument is that if we didn’t do it, we end up worse off when the violent, aggressive, evil Kiribatians invade our country and enslave us all. Note: I don’t actually believe this about Kiribati, just to say that out loud because approximately 33% of the internet does not understand humor.

Trade Balance

Is a trade deficit a good thing or a bad thing? Is a trade surplus a good thing or a bad thing?

Is a hammer a good thing or a bad thing?

These are all related questions, in that context is required. If I use a hammer to smash your car window and then beat you in the face to steal your vehicle? Probably bad! If I use the hammer to build a house and then sell it so we have more housing? Probably good! The context is really important here.

So let us consider the case of some real world trade deficit scenarios:

First, let’s go back to our lovely example of a tiny island nation. Say they have zero tariffs on the United States, but also, unfortunately for them, also pretty much zero economy. They export a bunch of fish they produce cheaply and import basically nothing, because they are super poor.

In that case, they are selling us cheap food, taking nothing back, but also have no capacity to take anything back. Nobody needs a $50k SaaS package there; Marc Benioff is powerless.

Second, let’s consider a country rich in natural minerals and with some local economy. Here, you can think of some oil-rich nations or similarly situated. There, we could be buying a natural resource we need more cheaply than we could get it somewhere else, which necessarily pushes the jobs to produce those resources there. Here, instead of Tom from accounting going out on a boat to fish, he’s working on an oil rig. Upgrade or downgrade? YMMV. Either way, he’s not in accounting. In this case, these countries do have the capacity to buy things from us, just less than we buy from them, and often it will be in the form of services (they hire our oil companies to run their stuff!), which hilariously will not be included in the trade deficit calculation above. So even if they run a trade surplus, it, uh, might show a deficit if we ignore the services we provide back to them.

Third, let’s consider a country like China. Here, we have someone who is deliberately attempting to deflate their currency to lower labor costs so they can bring manufacturing jobs onshore. They are also stealing IP from companies whenever they bring jobs there. They have large barriers internally to outside goods but allow a much more free market in internal goods. This would be the classic example of extractive protectionist mercantile policy, and in this case, the exports back to them are artificially low because of the internal trade barriers (as opposed to for core economic reasons, like in the case of the destitute island that only has fish). Particularly, they appear to be trying to establish a near-monopoly over certain strategic industries with this approach.

So now that we have some context, let us say that we run a trade deficit with all three countries. In each case, is this trade deficit a good thing or a bad thing?

My personal ranking would be good, good, possibly bad (the natsec argument carries much more weight here). Your mileage may vary on that, but it’s important to expose the reasoning and the bias. If you think bad in all three cases, I think you’re missing something important about core economics (specialization of labor exists for a reason and why are we upset with cheap good fish at low prices as a small part of total trade vs. making Tom from accounting take a 97% paycut to do hard manual labor), and if you think all three are good, you have completely discounted the natsec implications of outsourcing to zero.

The truth is likely in the middle, if we are being fair to both sides.

If you don’t agree with me on this, considering the following: as an American citizen, you personally run a trade deficit with Amazon, Walmart, Target, Costco or some combination thereof, most likely. I think we all agree there aren’t really national security implications to buying a Costco hot dog. Therefore, should you tariff them if they don’t buy your services in response? If I’m a hairstylist, should Amazon have to send their employees to me? If I’m a dog walker, should Costco have to buy some dogs to have me walk them? If not, should I tariff them massively?

Kind of silly when you look at it that way, huh?

Fuck the Poor

Donald Trump appears to hate the poor island nation. What I mean by this is that the way the tariffs have been implemented punish a nation like Kiribati for being poor.

The “reciprocal tariffs” are based purely on the trade deficit we have with countries. As we just discussed above, not all trade deficits are created equal. If a truly destitute island nation sells us $75mm of fish that they produced at sub-minimum wage levels, but imports nothing, Donald Trump is slapping massive tariffs on them for their “abusive” behavior towards the United States. This is true even if they have literally zero fucking tariffs on anything coming in, they just don’t have any fucking money because they are destitute.

The median income in Kiribati is about ~$3400 AUD, or ~$2150 USD, just to be clear. The US median household income is roughly $80,000. We are 40x wealthier than Kirbati, and now our trade policy is essentially going to punish them for being poor. What are they supposed to do to eliminate these tariffs? Suddenly get super fucking rich so they can buy Salesforce subscriptions (oh wait, that doesn’t even go into the calculation as an intangible good). Guess they have to buy… Teslas on their tiny island?

This plays out repeatedly when you look at the tariff rates for poor nations that sell us things cheaply and have limited to no capacity to buy anything from us. Essentially, Donald Trump’s tariff policy says that if you are poor and all you have to sell are natural goods and cheap labor and have nothing internally to buy with, you can get fucked and die. I might not even be exaggerating there; given some of the little that these people buy from us often are goods to keep their subsistence levels of agricultural production going, we may be damning millions to hundreds of millions of people to starvation.

Back to the Mines, Tom

Now let’s return to Tom from accounting. Tom previously had a job working for a company that provided accounting services to US firms, maybe somewhere boring and staid in a midwest city of <500k people, and had what could be described as a perfectly adequate life.

He had a house. It wasn’t fancy. He has a car. It’s a Hyundai Elantra, a few years old, not exactly a model of glamour but adequate. He’s got an iPhone that is a few generations old. He’s married and has one kid. They go to a perfectly adequate public school.

Guess what, Tom? You’re about to get fucked.

First of all, everything Tom buys is about to go up in price dramatically. Why? Because we just banned poor nations from selling to us cheaply, meaning the $40 sneakers that Tom wears that were produced by a 50 year old woman in Vietnam working 65 hours per week in a sweatshop at <$1 per hour wages now need to be produced by shiftless, kind of annoyed they have to be there teenagers and 20-somethings in the United States, at a minimum of $15 per hour for 1/4 of the productivity of the woman in Vietnam. Oh? That doesn't work economically? Then you just have to eat the 90% tariff to Vietnam to the face, meaning Tom's $40 sneakers now cost $76, assuming no other impacts.

And there will be many, many other impacts. That Hyundai? Now 2x the cost to repair, if you can repair it at all. iPhone? 50% more expensive. The house? Yeah, that too. The next time Tom’s washing machine breaks, it’s not getting replaced. They are back to washing clothes by hand because everything is so expensive things have to be cut somewhere, and given how much food and basic power now cost, the cuts have to come from things they really would rather have.

Oh, and Tom is crippled because he’s missing an arm and has only one eye. You think I’m joking when I say that, but I’m going to remind you that we just put Tom on a commercial fishing boat because his accounting firm closed and someone has to find us food. For those of you who have never worked on a boat like that, it’s hard, dangerous, and grueling labor. There is a reason that the overwhelming supermajority of on the job fatalities are men working in blue collar industries like the one we just assigned fat, out of shape accountant Tom to. He’s going to get paid less, work a far worse job where he never sees his family, lose his washing machine, get maimed in an accident, and then some bean counters in Washington are going to ask him if he’s tired of all the winning.

Fetishizing Low Value Labor

I don’t agree with Milton Friedman about everything, but one thing he was definitely right about is that we should not be obsessed with low value labor. The (apocryphal but directionally accurate?) parable of reducing productivity attributed to him lays that out nicely:

“While traveling by car during one of his many overseas travels, Professor Milton Friedman spotted scores of road builders moving earth with shovels instead of modern machinery. When he asked why powerful equipment wasn’t used instead of so many laborers, his host told him it was to keep employment high in the construction industry. If they used tractors or modern road building equipment, fewer people would have jobs was his host’s logic. “Then instead of shovels, why don’t you give them spoons and create even more jobs?” Friedman inquired.”

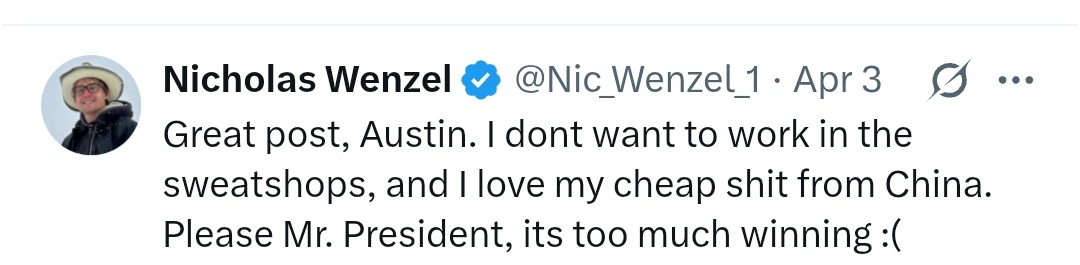

This is the mistake we are making with the blanket tariffs on low value production imports. If you want to know why I used the image up at the top, this is why. Fundamentally, we looked at the sweatshop in Vietnam I referenced above and instead of saying “thank fuck I work in accounting, that would suck, and I’m thankful someone is willing to do it” we instead said “actually, we want those sweatshops here”.

Read that again. We want the sweatshops back.

If you believe the tariff policy is about employment and trade imbalance based on the implementation we have engaged in, you must necessarily believe that statement.

After all, if it’s purely the natsec argument, we would be trying to automate the fuck out of factories to produce strategically important assets (and, to be clear, I’m sympathetic to that).

But punishing Vietnam for selling us shoes cheaply? What are we even doing here, unless we are saying that either:

1 – The US should absorb significant pain so we can exterminate the poor in other countries once and for all

or

2 – Actually we want those sweatshops back in the United States

Degrowth but Right Wing

The exceptionally strange part of this whole saga is that we just had a president lose an election over exactly this economic plan (or at least, this was a large component of the loss).

While it was expressed differently, the political goals of the Biden administration also aligned with the strange, obsessive desire to force Tom the accountant back out of the office and into manual labor.

In this case, the revitalization trade policy was based around reshoring American jobs in manufacturing, just like Trump. Through Biden, it was done with a combination of repressive antitrust (see the blocking of Nippon Steel’s acquisition), using the banking regulators to crack down on both tech and crypto access that were globalizing money flows and creating alternative vectors to state-controlled economic activity, and a general animus towards the tech sector producing things that were not “real”.

At the same time, the energy policy of “stop producing it here and raise prices” created a deceleration effect similar to what the Trump administration will achieve with tariffs, that is to say primarily raising the costs on American businesses while using the exact same amount of stuff as previous. In one case, it’s a tariff on Vietnam, in the other case, it’s blocking them from buying market rate energy to instead use “green” energy.

Also a weird refusal to build houses that drove prices up, which is related to making the cost of building houses much higher by putting tariffs on all the inputs to a house.

Both of these lead to the same place: the populist anti-elite degrowth agenda. An idealized version of happy Americans living in rural (if right wing) or walkable anti-car (if left wing) villages, where everyone does a job that involves producing goods with their hands (somehow pictured as sunny and happy instead of sweaty, injured coal miners in both cases), and nobody uses the internet (on the left, to break the tech monopoly, and on the right, because China is mind controlling us with Tik Tok).

The outcome, however, is the same, and weirdly dovetails with the Communist revolutions in Russia and China – massive regressions in quality of life combined with repression that leads to things like starvation and displacement. Decelerating the economy does not work the way you think, after all; it actually just straight up decelerates, you don’t have beautiful glide paths into utopia.

Oh, and the jobs you create? Low wage, power to capital, replaceable, physically backbreaking. Sweatshops for everyone!

What Year is It!?

The current moment in American politics is a strange one. It is as if someone took parts of the French Revolution, the movie Idiocracy, and Peter Zeihan’s “The End of the World is Just Beginning” and baked them all into a cake. Or maybe, given the haphazard nature of what is going on, a stew. There is less planning than a cake, to be fair.

We have the anti-elite populist moralist belief system that emerged in the French Revolution, with Elizabeth Warren on the left and Steve Bannon on the right positioning themselves as the would-be Robespierre’s of our moment.

We have people like Lutnick making fabulous claims about the efficacy of tariffs that fly in the face of reality but are nonetheless believed by the masses and create an anchor point that drags us down to the bottom of the ocean, just like Jacques Necker and his cooking of the books in the Compte rendu with ordinary vs. extraordinary expenses.

We have a previous economic regime collapsing under its own weight an inefficiency, just like the Ancien régime, only just like the French instead of a considered, clear effort at reform we’re just descending into chaos as we see what sticks to the popular conscious at any point in time.

Against that backdrop, we are rapidly deglobalizing the world in a way that will break supply chains, decrease aggregate productivity, and drop standards of living, similar to the descent into the dark ages in Western Europe when the Roman Empire collapsed. This was Zeihan’s core prediction in his book, and whatever you think about his call on Bitcoin (wrong), his call on geopolitics has been much better.

In short, all of the signs point towards chaos, displacement, and economic and political suffering.

Now What

The way out of these moments is not easy, but I think it starts here:

We have to reject incompetence. This is the Idiocracy component I mentioned above. If we want a well thought out tariff strategy in the interests of national security, I am not opposed to that (I might even be for it). But if we want a president vibe-prompting AI models to give him tariff strategies where he’s shooting from the hip while not understanding what a trade deficit is where the end goal is the destruction of poor countries globally, we should reject that in full. Not gently. Not partially. In full.

This is why I am writing this; now is not a moment to fall into tribalism (left or right – notice Biden was doing this same dumb shit in a different way). Now is not a moment to shy away in the face of history.

Rather, we must insist and demand that any of the leaders running our country have a clear, positive, coherent, and functional vision for the future. We need way less reality TV star and way more Paul Ryan energy (yes, he’s boring, but he was right). And if we can’t bring ourselves, as Americans, to do this, we’re going to be tumbling down the hill into some mix of Idiocracy and deglobalized cyberpunk dystopia with only ourselves to blame.

Nu o să repet /traduc ce a spus acolo, o să menționez doar că tarifele au sens când e vorba de protejarea interesului național strategic, de lupta împotriva monopolului comercial instituit de alte nații sau organizații politico-economice.

El se concentrează pe China, că îi arde cel mai tare și da, au sens tarifele către China, dar nici alea puse pe toate bunurile.

Au sens și tarifele impuse Europei – nu pe toate bunurile, nu neapărat în valorile alea, dar au sens. Nu ne convine să o spunem că suntem aliați , parteneri și na, europeni, dar na, UE nu acționează monopolistic precum China , dar ca un competitor economic al Statelor Unite, nu neapărat ca un partener. Nici nu spun că asta e rău, spun că unele tarife au sens

Problema e că cea mai mare rezistență la tarife, și care îi va afecta pe americani vine tocmai de la cele impuse spre China , cele impuse pe căcaturi și bunuri de importanță strategică națională mică, dar care crează un disconfort popular mare.

Iar publicul a observat relativ repede și reacționează, pentru că motivele pentru care lumea noastră a fost de acord cu externalizarea producției în China a fost că nu ne pasă, în general de condițiile de muncă și salarizare, decât ale alor noștri, oamenii de langa noi, cu care trebuie să interacționăm direct. Vrem lucruri ieftine și dacă trebuie să declasificăm niște cetățeni ai altor țări pentru asta, e OK, nu ne uităm în direcția aia. Evident, a venit la pachet cu costuri colaterale iar acelea nu ne plac.

Dar continuăm să vrem căcaturile noastre ieftine.

but… but… but Cristian Paun says that USA is dying by implementing these tariffs. And he is Ph.D. Professor of International Finance, International Risk Management and International Project Finance to Bucharest University of Economic Studies.

Băi , cred că am citit ce-a zis dom’ profesor despre asta. Nu știu dacă te referi la alte declarații pe care poate le-am ratat.

In afară de ce crede el că o să se întâmple cu SUA și că o să facă în continuare Donald Trump, aspecte care sunt opinii, ca și ale mele, și care nu pot garanta viitorul, raționamentul dumnealui nu e deplasat și nici ignorant, cu privire la mecanismele economice.

Și nu știu unde zice că SUA o să moară.

Cred ca vazusem cel putin o duzina de comentarii pe FB la el.

Nu stiu cat de deplasat este, vom vedea.

Si zici ca Ph.D. si “materiile prime…se produce”?🤤😜 Da bine, e doar un exemplu, dar industria chipurilor o sa fie cea mai vitala de adus inapoi in US. Poate nu numai pentru AI. Ca acum trebuie chipuri la orice… electrocasnice, roboti industriali, telecom, drone, rachete, tanchete, si alte jucarii. Dar chiar si pe textile…The two countries are reeling after Sri Lanka was hit with 44 percent tariffs and Bangladesh subjected to 37 percent levies. Officials in both countries scrambled to contain panic among business leaders, who worried that they may no longer be able to compete with bigger manufacturing powers,… Read more »

99% se produce

Da, dom’ne, ”româna e grele” – fiecare cum înțelege. Acordul predicatului verbal cu subiectul la diateza pasivă , când subiectul e un atribut care sugerează pluralul , fie formal la singular, dar acordul după înțeles la plural e acceptat. Mă rog, așa era când am studiat eu gramatica și sintaxa limbii române, lucrurile se mai schimbă în timp, iar Cristian Păun e chiar mai bătrân ca mine.

O parte dintre elevi va merge / vor merge în tabără.”

Dar, ca principiu, te iei de gramatica unui om când ai terminat cu argumentele, nu începi cu aia,că na, în limba română noi facem regulile și manualul de utilizare, nu la început, ci mai pe urmă, urmărind utilizarea și găsim reguli ca să acomodăm ceva ce sună bine, adică după ureche – și o spun sarcastic, dar nu critic, dincolo de amuzament.

N-am nicio pasiune pentru el – când am găsit ceva de comentat, am făcut-o, dar ce văd în postul ăla e un rant, pe care îl iau ca atare, cu privire la sensul a ceea ce spune – da, e un pic de sens, deși nu-s în acord cu el din alt punct de vedere.

Ceea ce sugereaza e că americanii nu mai vor să facă muncă manuală prost plătită și migăloasă ( ”muncă de chinez”) și aici are dreptate.

Ceea ce nu cuprinde în rant sunt două aspecte:

1) Mai sunt încă destui imigranți în US care se pretează la genul de muncă și altfel poate să fie problematic, până nu îi dă pe toți afară, lol.

2) S-ar putea, cu noul val tehnologic, să nu mai ai nevoie de respectiva muncă migăloasă și prin forțarea producției în interiorul US să forțeze noul val tehnologic. Acesta din urmă este, probabil, un pariu al administrației curente, nu o certitudine, dar nu e un pariu rău, dacă le iese.

Trump a sustinut ca a pus tarifele din 2 motive: Sa aduca industria inapoi in sua Sa negocieze mai bine cu alte tari acorduri comerciale De 1 s-a discutat destul dar de 2 nu. Eu personal cred ca o sa plimbe tarifele alea si o sa le bage si o sa le scoata de nu e adevarat, mai ceva ca in injuraturi. O sa zica uite am facut nu stiu ce intelegere cu EU, ia uite ce negociator sunt eu, am scos tarifele la baghete frantuzesti sau cine stie ce industrie specifica, dupa o sa zica ca vai dar cumpara… Read more »

Ar trebui, da, că dacă nu cumpără nimeni pierderile mele potențiale sunt destul de semnificative.

cred ca mai dureaza nitel caderea aia. Plus ca zilele astea se pune stop joc pe bursa. Taiwanu au facut-o deja

io is ok. de la +1000sumpic de euro la -2000 -2500

Nu plang. Nu plang deloc 😀

Nici n-are rost să mă uit. Ăsta e la portofoliul de Europa.

Pe US sunt de la +3000 la -450. Momentan nu îmi pasă că eu operez oarecum pe DGI. Până nu taie dividendele sunt relativ OK, când ( nu dacă) or să înceapă și cu aia, atunci lacrimi și suspine.

Momentan nu s-a prăbușit economia, doar bursa din jurul ei. Unii ar fi zis că era supraapreciată oricum. Dar na.

io am super dividende. Cred ca iau 1dolar/an

da nici nu am atata investit

bah, un prost arunca o piatra si 1000 de oameni se chinuie sa gaseasca motivul ascuns. Nu se poate sa fie ala atat de prost. Are el o jmecherie undeva.

Io am tot zis de zero sum game. Parea ca is nebun. Azi a declarat cu subiect si predicat: tarifele is acolo ca el vrea ca toti sa cumpere cel putin pe cat cumpara sua de la ei.

Pentru ca “deficit is a loss”. Asta e gandire de “mare om de afaceri”: daca iti dau bani pe un produs/serviciu sunt in pierdere.

Nu părea că ești nebun – dar nici nu ai dreptate musai. Nu e că economia e zero sum game, sau că Trump vrea asta, că economia nu se rezumă la producție. Doar că trump vrea balanță comercială 0 pe bunuri, în cel mai rău caz, adică producție, adică industrie. Serviciile separat, că acolo conduc. Deficit is a loss – fără îndoială, dar asta e o mică problemă. Problema mai mare e geopolitică, socială și strategiile de la un nivel mai sus. Băi, problema reală e că s-a produs ”o extorsiune” de la viziunea americană – și parțial britanică, aia… Read more »

boss..iar faci greseala sa incerci sa intelegi ceva de neinteles. “deficit is a loss”. Ce pula mea e asta? Adica daca io cumpar ceva de la tine…eu am pierdut? CUM PULA MEA vine asta? Economia nu e zero sum game. Poti avea parteneri care castiga amundoi. Dar nu pentru cacati portocalii, al carui MO era “nu imi platesc contractorii” Ai problema ca china creste? Fute China. Nu fute si canada ca china creste. “Vai, BYD, deci petrolul din canada il tarifam”. Like what? Am zis-o de mult ca alte margareta a futut un cal in pizda cand a vrut Ukul… Read more »

CUM PULA MEA vine asta? Cam ca România . Care a mers pe deficit comercial constant și care trebuie compensat. Compensarea poate fi – cel mai simplu, prin devalorizarea monedei locale, lucru care, culmea, are sens și e de dorit tocmai când ai excedent comercial, nu când mergi pe deficit. Când mergi pe deficit vrei monedă tare – vezi Marea Britanie – motive pentru care n-au vrut intra în zona Euro. Ca să menții paritatea monedei, trebuie să injectezi bani de undeva, fie împovărezi populația cu taxe și le faci scheme să-i jumoli de ei – oricum ai de ales… Read more »

E bine patroane. Noi vorbim de america si tu imi dai exemplu Romaniei. Mai ai exemple d-astea epice? Leul e la fel, moneda de referinta in lume? Balanța comercială nu e musai să fie 0 cu fiecare partener Adica vrei sa zici ca balanta comerciala e ceva mai complexa decat “tre sa cumperi mai mult decat iti vand eu”???? N-are cum patroane. Omu a zis ca deficitul e pierdere. Fara glume d-astea cu “nu musai cu fiecare partener”. El ar vrea ca Vietnamu sa cumpere de aceeasi valoare cu care cumpara americanii de la ei. Ca altfel “ne folosesc”. Taci… Read more »